Are you a small business owner in the West Boulevard corridor? Join us for the launch of the West Boulevard Merchants’ Association! Our Merchants’ Association is an opportunity to highlight and support the small businesses in the West Boulevard corridor. Join us at the Launch Meeting and learn more about what a Merchants’ Association is, why you need to be a part, and help us to build out a Merchants’ Association that meets your business needs.

Financial

Gap Loans

Common Wealth Charlotte (CWCLT) has expanded its qualifications for income-gap loans to Mecklenburg County residents.

Now, anyone qualifies who work in the restaurant, food service, hospitality, retail, customer service, call center, professional services (hair stylists, nail technicians, pet groomers, etc.), transit (Uber/Lyft) and other service industries who have been laid off, furloughed or had hours reduced due to the COVID-19 pandemic.

CWCLT now offers full service to you if Spanish is your native language.

Loans have 0% interest and a 12-month repayment term, AFTER a 6-month no-payment-due grace period. (A loan on April 20 would not have a payment due until October 20.) Clients receive extensive follow-up financial counseling at no cost, and repayment of the loan once employment returns can have a positive effect on credit scores.

If you qualify or know someone who does, Text the word FINANCES to 474747 or Mande un texto con la palabra FINANZAS al 474747 and a CWC advisor will be in touch.

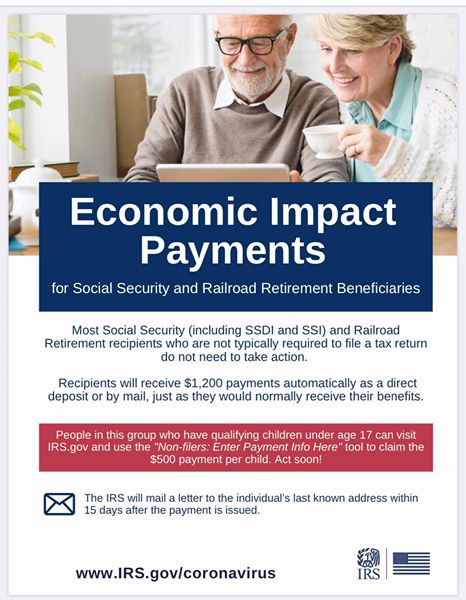

Economic Impact Payments

Following extensive work by the IRS and other government agencies, $1,200 automatic payments will be starting soon for those receiving Social Security retirement, survivor or disability benefits (SSDI), Railroad Retirement benefits, Supplemental Security Income (SSI) and Veterans Affairs beneficiaries who didn’t file a tax return in the last two years. No action is needed by these groups; they will automatically receive their $1,200 payment.

For those benefit recipients with children who aren’t required to file a tax return, an extra step is needed to quickly add $500 per eligible child onto their automatic payment of $1,200.

For people in these groups who have a qualifying child and didn’t file a 2018 or 2019 tax return, they have a limited window to register to have $500 per eligible child added automatically to their soon-to-be-received $1,200 Economic Impact Payment.

A quick trip to a special non-filer tool on https://www.irs.gov/coronavirus/non-filers-enter-payment-info-here by noon Eastern time, Wednesday, April 22, for some of these groups may help put all of their eligible Economic Income Payment into a single payment.